Every trader is aware that the words of certain individuals can significantly impact the financial markets. Speeches from heads of central banks, presidents of international investment funds, and even heads of state can trigger high volatility.

While this volatility often subsides within a few hours, a more intriguing question arises: Can a single speech actually shift a medium-term or even long-term trend? This article explores this possibility through real-life examples.

Article content

Dollar and Gold: December 2024

On December 18, 2025, the US Federal Reserve held another meeting to discuss the key interest rate. As expected, the rate was reduced to 4.5-4.75%. However, the focus wasn’t on the rate decision itself but on the press conference held afterward by Fed Chair Jerome Powell. He mentioned that the Fed would base its decisions on the actual economic situation and didn’t rule out a prolonged pause in the rate-cutting cycle.

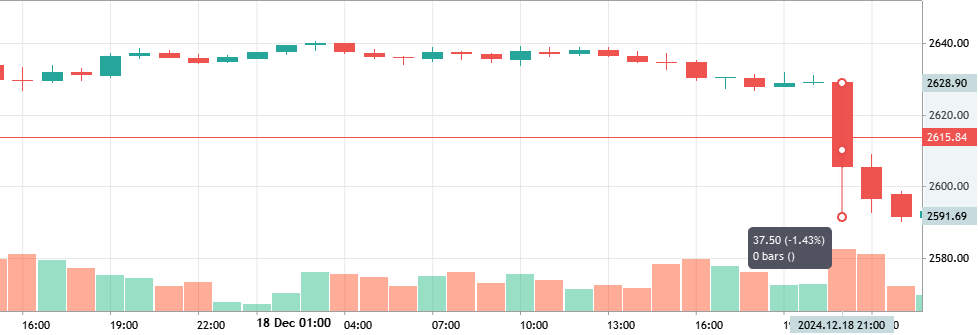

It’s important to note that while the key rate affects domestic price growth, it also influences international investments and, consequently, the national currency’s exchange rate. Since the US dollar is recognized globally as a safe-haven currency, Powell’s remarks significantly impacted the price of another safe-haven asset – gold. The XAU/USD chart from this period looks like this:

Gold’s losses amounted to nearly 1.5%. Could this lead to a long-term trend reversal? It’s certainly possible, but let’s look at similar instances from previous years to get a clearer picture.

Crisis in the Eurozone: July 2012

By the summer of 2012, the European debt crisis had triggered one of the most significant and prolonged downward trends for the euro. The currency had been falling since the spring of 2011, losing over 15% of its value against the US dollar.

On July 26, 2012, European Central Bank (ECB) President Mario Draghi delivered a landmark speech. The key message: “We are ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Traders who believed him were rewarded with substantial profits, as his speech not only sparked a sharp rise in the European currency but also marked the start of an upward trend that lasted almost two years. The euro climbed by more than 10%.

The Start of US Rate Hikes: December 2015

Nearly 10 years ago, then-Fed Chair Janet Yellen announced a gradual rate increase and the end of the “era of cheap money.” After the global financial crisis, minimal rates were maintained to stimulate the economy.

At the time, investors correctly interpreted the signal: higher rates make the national currency more attractive. Here’s how the USD/JPY chart looked before, during, and after the Fed Chair’s speech:

Following a prolonged period of flat trading, the dollar began to strengthen rapidly, ultimately rising by nearly 15.5% against the yen over the next six months.

What Does This Mean for Traders?

As you can see, a single speech can not only shake up the markets but even reverse the long-term direction of a currency. Powerful words from key figures in global finance can have a profound impact. And you can find more examples like the ones we’ve mentioned above: Christine Lagarde announcing IMF reforms or Ben Bernanke unveiling the quantitative easing program. These events highlight a crucial truth for traders: a landmark speech can significantly impact market volatility and potentially shift long-term trends.

The challenge lies in identifying these truly impactful speeches amidst the constant stream of announcements. Here are a few tips how to spot them:

- Focus on serious topics: Look for speeches addressing major global issues like interest rate hikes, changes in monetary policy, or commitments to support specific currencies.

- Recognize pre-existing trends: Significant policy shifts usually occur when there are significant problems. If a developed country’s currency experiences a prolonged decline or, conversely, exhibits uncontrolled growth, it often leads to the very difficulties that policymakers will then seek to address.

- Verify actions with words: Pay close attention to the actions of governments and central banks following a major speech. Words alone rarely dictate long-term outcomes.

- Monitor key indices: Observe how influential speeches impact key market indices, such as the US dollar index (DXY). Additionally, track indicators reflecting the health of the corporate sector, like the NASDAQ or Dow Jones, for a more comprehensive understanding of market sentiment.

Conclusion

In today’s fast-paced world, the power of words in shaping global economic trends is undeniable. To enhance your trading success, consider these key strategies: Pay close attention to statements from influential figures in global finance. Observe how markets respond to these speeches and identify potential trading opportunities. Always implement risk management strategies to protect your investments during periods of heightened volatility, such as those following major announcements.

By incorporating these practices into your trading journal, you can gain a deeper understanding of market dynamics and improve your decision-making across various asset classes, including currencies, cryptocurrencies, metals, and indices.