Gann Angles (also known as the Gann Fan) are among the most popular tools in technical analysis. They were developed by the legendary trader and analyst William Delbert Gann in the early 20th century. Gann believed that market prices moved in geometric patterns and that specific angles could help forecast future price movements.

Today, Gann Fans are widely used by traders across different markets—from stocks and forex to cryptocurrencies and commodities.

Article content

What Are Gann Angles?

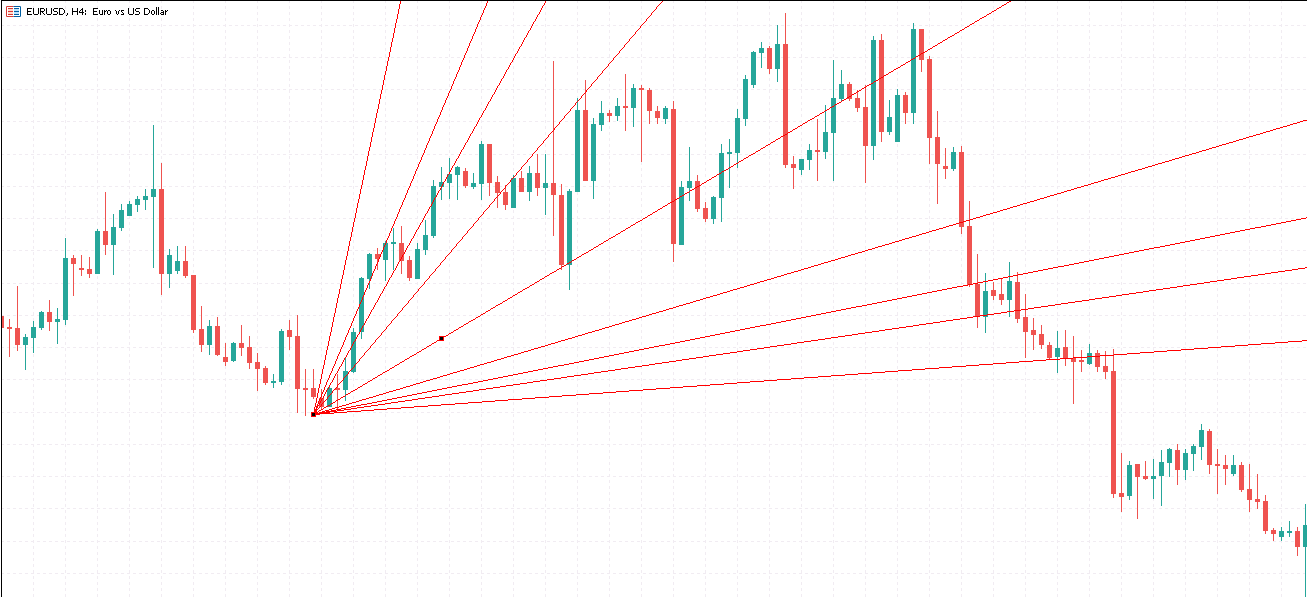

Gann Angles are diagonal lines drawn on price charts, similar to trend lines. They originate from key highs or lows. According to Gann’s theory, markets move from one angle to another, with each angle carrying unique characteristics and exerting influence on price behavior. One of the main advantages of using Gann Angles is their ability to help traders quickly identify support and resistance levels, spot potential trend reversals, and even estimate the timing of major market moves.

While there are multiple angles, the most important is the 1×1 angle, which reflects a perfect balance between price and time—forming a 45-degree slope.

Other commonly used angles include:

- 1×2 – A gentler slope, where the price is moving slower than time

- 2×1 – A steeper slope, where time is moving faster than price

More extreme variations, such as 1×4, 4×1, 1×8, or 8×1, are occasionally used but are generally less common.

How to Properly Apply Gann Angles

Step 1: Choose a Timeframe

In theory, Gann Fans can be applied to any timeframe. However, they’re more reliable on higher intervals—ideally on 4-hour charts or above. The higher the timeframe, the less market “noise,” which makes the indicator more accurate and meaningful.

Step 2: Identify a Reference Point

Start by selecting a significant price level—a major high or low. This will serve as the anchor point for drawing your angles.

Step 3: Draw the Angles

From your selected point, draw a line upward or downward depending on the trend direction. The Gann Fan tool will automatically create additional lines at different angles, forming the full “fan.” These act as dynamic guides for potential support and resistance as the price evolves.

Gann Angles as Support and Resistance Levels

When the price is above a key Gann line, it typically signals that the trend is still intact. A downward break below that line may suggest a weakening trend—or a potential reversal—depending on the strength of the move. In such cases, traders should closely monitor the market and be ready to act, especially when other factors—like important fundamental news—are in play.

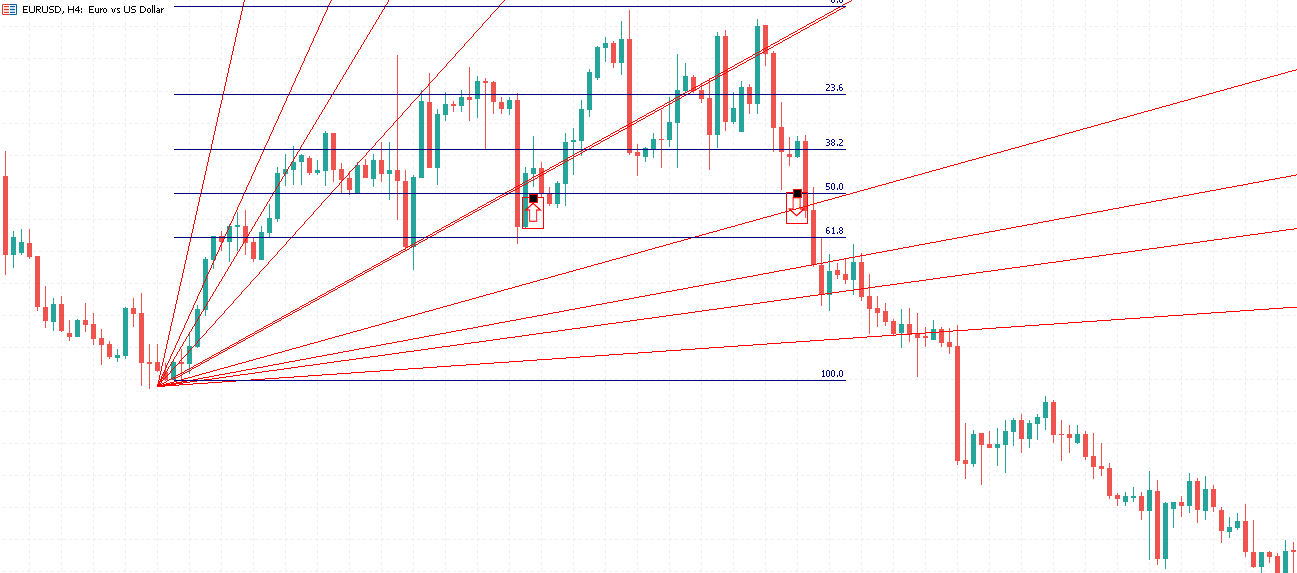

It’s also useful to combine Gann Angles with horizontal levels, such as the 50% retracement.

The intersection of diagonal and horizontal levels creates strong zones of support or resistance, often referred to as “price clusters.” These areas are especially significant. As with any analysis technique, it’s important to confirm signals with other tools. That principle absolutely applies when using Gann Angles.

Gann Angles vs. Trend Lines

Gann Angles are often mistaken for regular trend lines, but they’re fundamentally different:

- Trend Lines are drawn by connecting important highs or lows and typically require frequent adjustments as the market changes. This makes them less reliable for long-term forecasting.

- Gann Angles, on the other hand, move at a constant rate of time and price. Because they don’t shift, traders can project where these lines will appear in the future—days or even weeks in advance—making them more suitable for forward planning. As noted earlier, they work best on higher timeframes. On shorter intervals, they can produce false signals and lead to confusion.

Conclusion

The Gann Fan can be a valuable tool in your trading strategy. While it’s not ideal for scalping or ultra-short-term trades, it provides powerful insight into the strength and direction of a trend for those with a more patient approach. Despite being developed nearly a century ago, Gann’s method remains relevant today due to its simplicity and adaptability.

That said, no tool is flawless. Gann Angles are most effective when used in conjunction with other technical indicators. With consistent practice, a solid chart setup, and a thoughtful blend of tools, you can learn to apply Gann Angles effectively—and make smarter, more confident trading decisions.